Zerodha didn’t depend on a long list of marketing channels. Instead, it focused on a few that matched how modern investors behave. These tactics helped them grow without investing in paid ads.

Six out of ten people on the internet today talk about investing in the stock market. But, you see, investing has never been easy. And people who started investing in the early 2010s know how difficult it felt. Opening a trading account took days. Brokerage fees were high. Platforms looked complicated, and every action needed a phone call to a dealer. It felt like the entire system was for experts.

It was not for everyday people who just wanted to invest. In August 2010, Nithin Kamath and Nikhil Kamath, from Bangalore, decided to fix this gap.They launched Zerodha, a brokerage designed to remove the barriers that kept regular Indians away from the markets.Their idea was to lower the cost of investing, make the platform easy to use, and explain everything in plain language so beginners didn’t feel lost.

However, the problem was that old firms with high fees, slow processes, and complex tools dominated India's retail brokerage industry. Trust was also a challenge.People don’t switch platforms easily in the financial space. They need a brand that feels reliable, open, and serious about protecting their money.Zerodha entered this tough market without massive advertising budgets. Yet over the years, it grew into one of the largest brokers in India.

But how?

Get your gear on and let’s plunge!

When Zerodha entered the market, most brokers appeared similar.They charged high brokerage fees, built complex platforms, and relied on sales teams to bring in clients.

For average Indians who wanted to start investing, the initial reaction was usually confusion or fear. The barrier wasn’t just money. It was the feeling that “this world is not for me.”Zerodha built its positioning around removing that barrier completely.

Even the name reflects this thinking. It comes from two words: “Zero” and “Rodha” (Sanskrit for barrier). The promise was clear from day one:

Make investing simple, affordable, and open to everyone.

Their core insight was straightforward:

Retail investors weren’t participating because the system was expensive, complicated, and full of jargon. If someonefi built a platform that removed these pain points, a large audience would finally enter the market.

Zerodha designed its value proposition around that insight:

This approach gave Zerodha a marketing advantage. Instead of trying to “look different,” they focused on being different. Their message, investing without barriers, was tightly connected to their product, pricing, and communication. In a market full of complicated processes and percentage-based fees, Zerodha stood out by offering simplicity, clarity, and control.

Zerodha didn’t treat its product and pricing as support functions. They turned both into core marketing strengths.

In a market where brokerage fees were confusing and platforms felt outdated, Zerodha used clarity and simplicity as tools to win trust.

The massive shift was their discount brokerage model. Most brokers charged a percentage on every trade, which made fees unpredictable. Zerodha introduced a flat-fee structure and kept equity delivery at zero cost. For a new investor, this removed the fear of being charged for every action. The pricing itself became a reason to try the platform.

Zerodha understood early that most Indians wanted to invest but didn’t know where to begin. The fear wasn’t about losing money.

It was the fear of not understanding what they were doing.Instead of pushing messages, Zerodha focused on teaching people how markets work. This decision became one of their best growth engines.Their biggest educational asset is Varsity, a free learning platform that explains markets in clear, step-by-step modules.

Zerodha didn’t depend on a long list of marketing channels. Instead, it focused on a few that matched how modern investors behave.

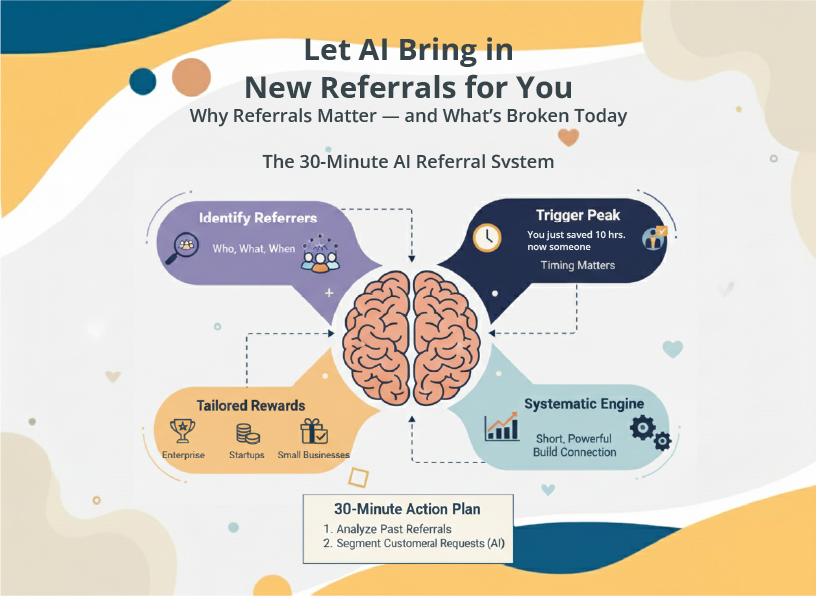

These tactics helped them grow without investing in paid ads.The most crucial channel was their referral system. Users could invite friends and earn small rewards or incentives.

But the real power wasn’t the reward. It was trust. People usually choose a broker based on advice from someone they know. By making referrals effortless, Zerodha turned every satisfied user into a natural promoter. And search played a massive role, too.

Zerodha also benefited from the founder's visibility online. Clear communication from the leadership built credibility and gave the brand a human voice.

Key Takeaways from Zerodha’s Marketing

(screenshot this)